but you could get there faster

Why Incentives Solutions

We are a leading SPM platform, providing organizations with Business Insights to GROW their bottom line, SIMPLIFY their sales operations processes and gain better CONTROL over their commission payment budget.

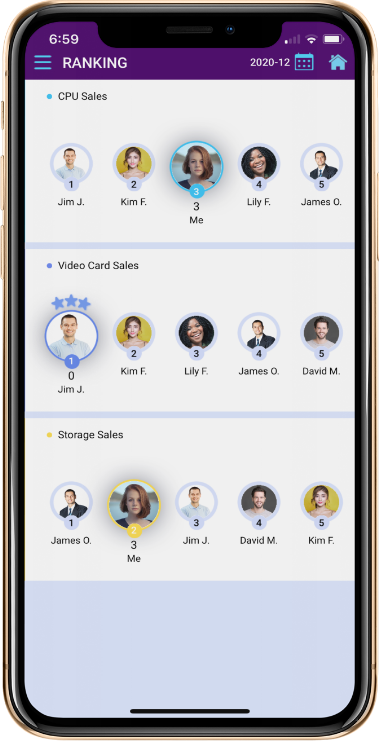

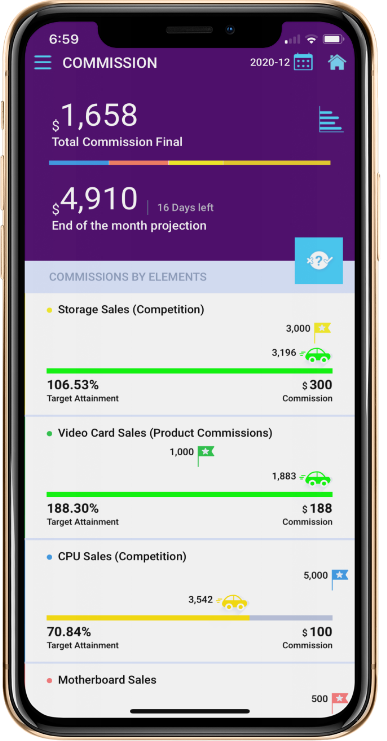

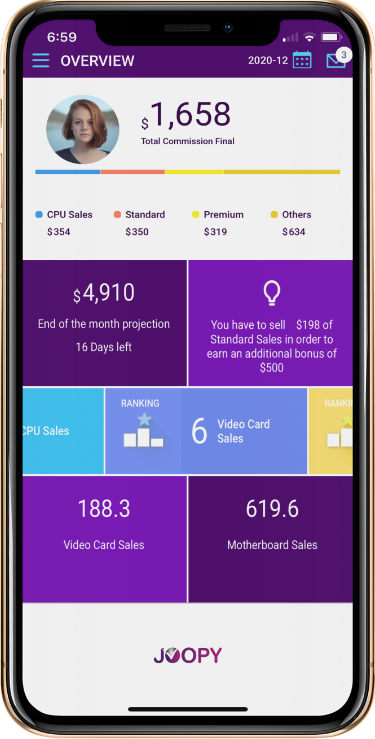

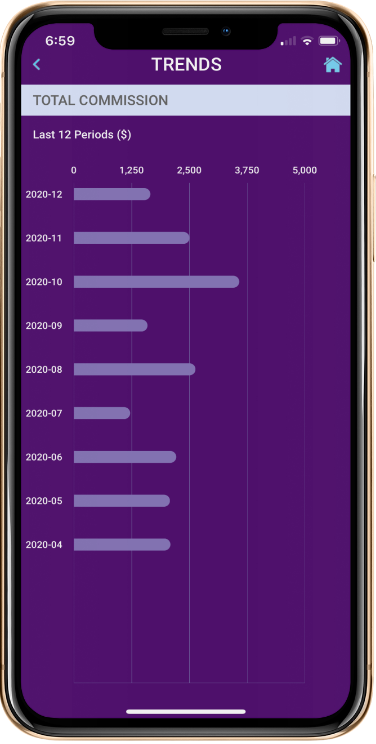

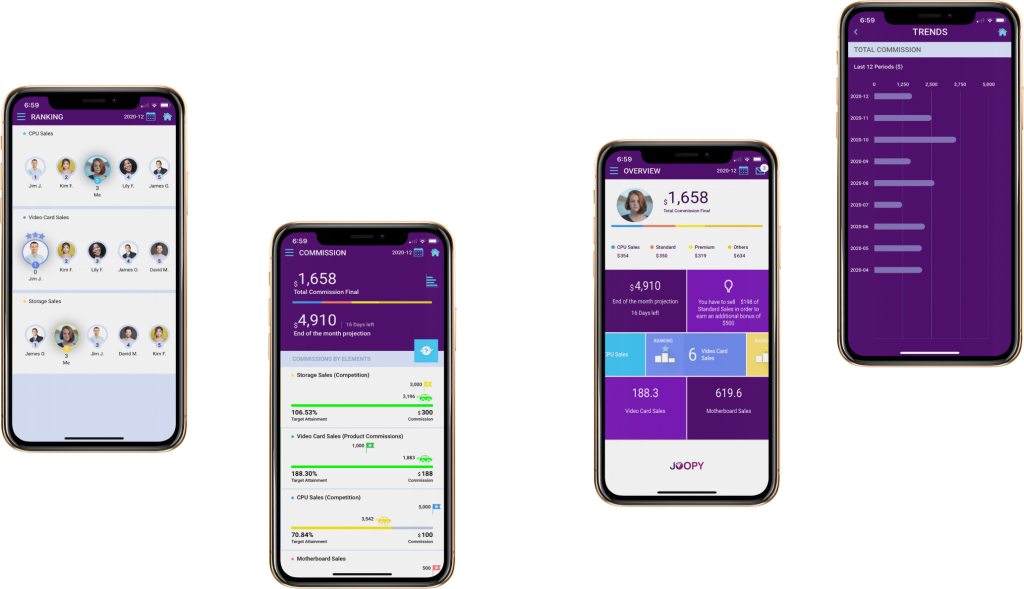

Our advanced cloud based platform, JOOPY, facilitates the entire working processes and calculations of commission, incentives and bonuses among organizations.

JOOPY is intuitive, fast to deploy and easy to modify, enabling unprecedented time-to-value, significant business growth and rapid Return On Incentives (ROI).

GROW

your business

SIMPLIFY

your sales processes

INCREASE

trust and loyalty

of your employees

CONTROL

your commission

payment budget

Why Incentives Solutions

We are a leading SPM platform, providing organizations with Business Insights to GROW their bottom line, SIMPLIFY their sales operations processes and gain better CONTROL over their commission payment budget.

Our advanced cloud based platform, JOOPY, facilitates the entire working processes and calculations of commission, incentives and bonuses among organizations.

JOOPY is intuitive, fast to deploy and easy to modify, enabling unprecedented time-to-value, significant business growth and rapid Return On Incentives (ROI).

So what our customers say about us?

“JOOPY provides a complete solution to the needs of springs using the latest technologies. It reflects employees in real-time their performance and expected payments, increases the competitiveness among employees and thus contributes significantly to improving their performance, and accordingly – to improving the service provided to our customers. ”

“The company is a multidimensional organization, with significant complexities and differences. The Human Resources Department was looking for advanced technological tools that will help the organization and managers at all levels on two levels: ongoing measurement of the performance level and meeting the company goals of each of the employees and increasing their motivation and empowerment also with periodic performance-based compensation”

“The system has definitely proven itself. The system has contributed significantly in increasing the motivation and performance of its “clients” in Customer Service and Sales and helped increasing the level of control and supervision at the Accounting Department. Since its deployment, Incentives Solutions is a provider and contributor to AIG’s growth and development. “

“Incentives Solutions enabled us to provide every employee and manager with focused, detailed, quality information and motivation to reach their targets and enable them to succeed. Their success is our success.”

“The new system allows us to delve deeper and increase engagement of our employees in their sales and service processes; in addition, we can create excellency processes through significant use of the competition features and the Go JOOPY mobile application. We are experiencing a significant increase in the use of the system by the salespeople and employees, and we have no doubt that these processes will contribute to additional improvements in our business results.

“We found a real partnership with Incentives Solutions. The solution as well as the professional implementation process, allowed us to deploy our models in an effective manner and reach the entire global sales organization. The availability, transparency, and up-to-date visibility of information allow the entire sales to have a ‘finger on the pulse’ and attain their sales targets.”